Table of Content

TaskRabbit connects “Taskers” with people who need things done, whether that be picking up groceries, moving across town, assembling an Ikea desk, or performing yard work. Taskers get paid after the completion of a task via TaskRabbit’s online payment system. Their 24/7 support is ready to assist in times of need.

Give someone a referral code, and they receive $20 in credit. As a server for Sprig, you will deliver hot, organic meals to hungry customers. Set your own shift that fits your schedule and earn between $16-25/hour. To refer another shopper, give them the same code you used to refer a user.

Somewhere to Meet Clients, Patients, and/or Customers

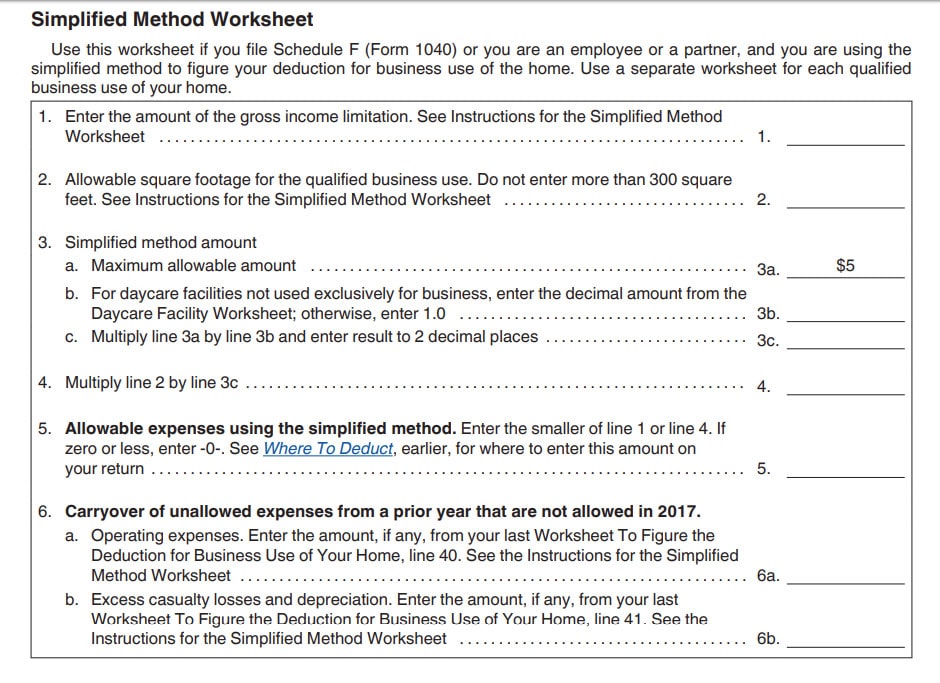

We’ll find every industry-specific deduction you qualify for and get you every dollar you deserve. Most rental activities will qualify as Section 162 trade or business activities. You have to look at case law and make a judgment call. You have a separate, free-standing structure not attached to the home, such as a studio, garage, or barn that you use exclusively and regularly for your trade or business... You can calculate your home office deduction using the traditional method or the optional simplified method.

You can determine the value of your deduction the easy way or the hard way. Harbor” option for anyone worried that an accounting error might get the attention of the IRS or other regulatory agencies. For a full schedule of Emerald Card fees, see your Cardholder Agreement. Supporting Identification Documents must be original or copies certified by the issuing agency. Original supporting documentation for dependents must be included in the application. Payroll Payroll services and support to keep you compliant.

Regularly and Exclusively

As a Postmate, you may deliver food from a restaurant, a Frappuccino from Starbucks, or someone’s dry cleaning. To work, you must be over 18 and own a bike, car, truck, scooter, or motorcycle. Postmates receive 80% of the delivery fee and 100% of any tips they make; money is deposited into couriers’ accounts weekly. An ITIN is an identification number issued by the U.S. government for tax reporting only. Having an ITIN does not change your immigration status. You are required to meet government requirements to receive your ITIN.

The IRS says that personal commuting is not deductible. Thus, for example, you can’t deduct the cost of driving from home to your regular outside office. For example, if your home office is 200 square feet, you’ll get a $1,000 deduction. You can only use this method if your home office is 300 square feet or less. If you work in more than one location, your home office can still be your principal place of business.

You Use A Separate Structure For Business

According to promotional materials, Gett drivers can earn 2-3 times UberX’s normal minute rates. During regular hours, you can earn $0.50/minute + Tip, and during peak hours, you can rake in as much as $0.90/minute + Tip. NerdWallet strives to keep its information accurate and up to date. This information may be different than what you see when you visit a financial institution, service provider or specific product’s site.

The student will be required to return all course materials. Having an office in your home can provide valuable tax benefits for owners of rental properties. It turns non-deductible household expenses into tax deductions.

How the IRS Home Office Rules Work

Of the two methods available, this is the more complicated route. However, if you are anticipating a lot of home office related expenses, then the regular method may be the way to go. There are two options for calculating the home office deduction. We’ll introduce you to both, so you can decide which works better for you and your particular circumstances.

You use part of the home for the storage of inventory or product samples. Your home must be the only fixed location of the trade or business. You must use the storage area on a regular basis, and it must be suitable for storage. It takes more than a personal computer to classify your spare bedroom as a home office.

It does not provide for reimbursement of any taxes, penalties, or interest imposed by taxing authorities and does not include legal representation. Additional terms and restrictions apply; See Guarantees for complete details. These criteria will effectively disqualify many filers who try to claim this deduction but are unable to prove regular and exclusive home office use. However, it is not necessary to partition off your workspace to deduct it, although this may be helpful if you are audited. A desk in the corner of a room can qualify as a workspace, as long as you count only a reasonable amount of space around the desk when computing square footage.

Most state programs available in January; software release dates vary by state. State e-File for business returns only available in CA, CT, MI, NY, VA, WI. Description of benefits and details at hrblock.com/guarantees.

Roadie is the neighbor-to-neighbor shipping network that connects “Roadie” drivers to people who need items shipped from one location to another. Roadies can browse “Gigs” by price, location, distance and size and decide which gigs they want to take. The majority of local Gigs pay between $8-20, and long distance Gigs with oversized items can pay up to $200. When on the road, Roadies get special discounts on food, gas, and more. For delivery, if you refer a friend, tell them to mention your name when they apply or when they come in for orientation.

No comments:

Post a Comment